OUT OF THE WOODS?

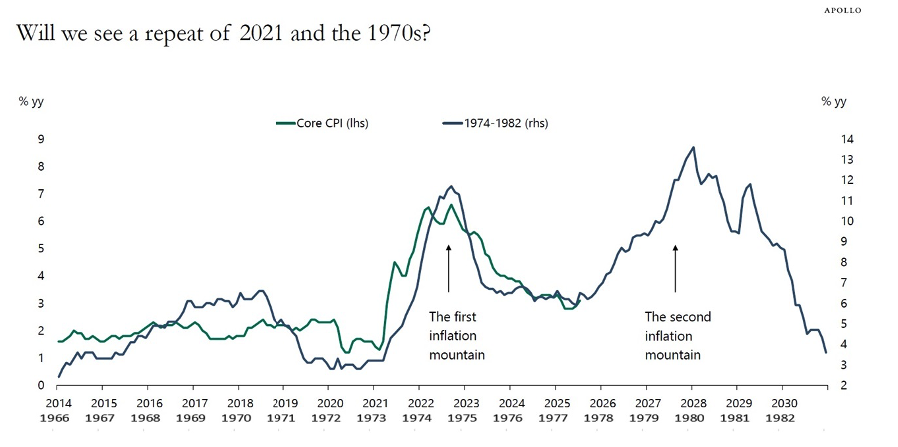

We don’t intend to fearmonger with the charts above, but rather put forward an argument for caution in an environment where caution seems to have been thrown to the wind.

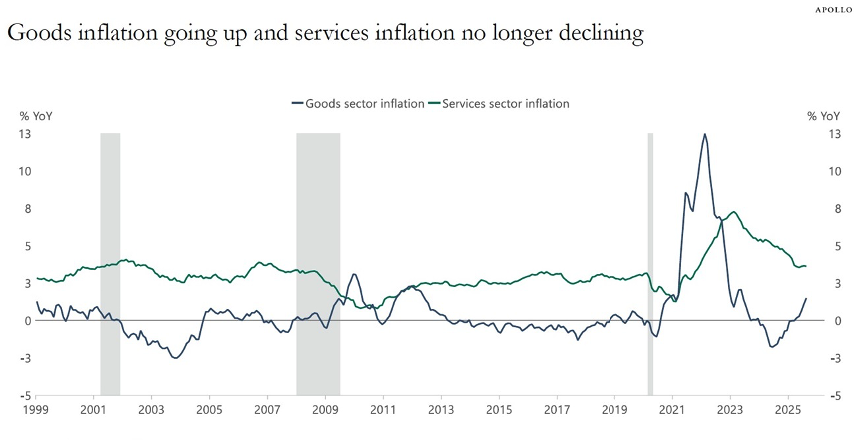

In 2025, there are more policy tools for central banks, an improved understanding of reaction to said policies, and the ability to revisit the charts above for inspiration. In combination, those factors dramatically reduce the risk of a second inflation spiral. But sticky inflation alongside tariffs and a weaker U.S. dollar make expected rate cuts less likely, barring further material degradation of employment figures.

In other words, we are not out of the woods.

We don’t intend to fearmonger with the charts above, but rather put forward an argument for caution in an environment where caution seems to have been thrown to the wind.

In 2025, there are more policy tools for central banks, an improved understanding of reaction to said policies, and the ability to revisit the charts above for inspiration. In combination, those factors dramatically reduce the risk of a second inflation spiral. But sticky inflation alongside tariffs and a weaker U.S. dollar make expected rate cuts less likely, barring further material degradation of employment figures.

In other words, we are not out of the woods.

Playing your Own Game

A classic from Morgan Housel on the value of understanding your own biases.

One of the most important ideas in finance is realizing that some people are playing a different game than you are…One of the most important financial skills is figuring out and identifying what game you are playing.

Gold Rush for Infrastructure

A massive trend combined with a warning. There is currently a huge opportunity in infrastructure as private capital is desperately needed for a swath of assets across power, data centers, and transportation.

There are attractive and very stable returns to be found here with the managers who know the space. Those with scale who are negotiating attractive long-duration contracts and effectively offloading risk are likely to do extremely well in the coming years. But as usual, when a sector is attracting an unprecedented amount of capital, someone is going to be left holding onto that risk at the wrong time.

In total, the largest hyperscalers are estimated to spend $300 billion on data centers this year, Blue Owl Capital’s head of digital infrastructure Matt A’Hearn wrote in April. By the end of the decade, McKinsey & Co. estimates $7 trillion will be spent in total across the digital infrastructure ecosystem, a figure that includes $5.2 trillion estimated as needed for data centers alone.

Are we living in a stupidogenic society?

An exploration of the “cognitive offload” effect that is becoming much more prevalent in society and education. There are many basic forms of “offload” that are easy to come up with: if you can use ChatGPT to write your essay, you won’t become a great writer; if you use GPS at all times, you won’t have great navigation skills.

There are also less obvious second-order impacts to this “offload” that could have huge impacts on the development of the current generation and those to come.

Every solution contains within it the seed of a new problem. In fact, there are no solutions, only trade-offs. The new problem here is that a lot of the basic routine tasks we’ve offloaded to machines had very useful by-products that we have now lost.

Why your attention keeps slipping away

No one needs to be reminded of how distracting the modern world has become. Attention as a “product” has effectively led to an entire segment of the economy being solely dedicated to stealing our focus. At the risk of stating the obvious, it’s in our best interest to constantly defend against that threat.

The difference between people who achieve their most important goals and those who stay stuck often isn’t talent, luck, or even opportunity. It’s mastering the invisible skill that makes everything else possible: intentional, directed attention.

Gallant MacDonald is a Private Investment Office serving a select group of ultra-high net worth families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!