Happy Holidays!

In a year where we have written about artificial intelligence (AI) too many times, it seemed only appropriate to generate the above for the holidays. That, or we forgot to take a team photo at the company party because we were wrapped up in a murder mystery, and far too vested in finding the perpetrator (it was Jeff).

Regardless, we want to take this opportunity to wish you all a wonderful holiday season. Sincerely hoping the coming weeks are filled with quality time with family and friends as we head into the New Year.

The team at Gallant MacDonald appreciates all the support over an incredible year in 2025!

Teaching When To Trust

Discerning the real from the fake is a skill that is crucial to being a functioning member of modern society, one that is only going to gain importance in the coming years. As usual, those crafty Finns have it sorted.

Students learn how to spot deception across subjects: in maths, they see how statistics can be manipulated; in art, they explore how images can convey misleading messages; in history, they study famous propaganda campaigns; and in Finnish, they examine the many ways in which words can be used to confuse or mislead. Training in scepticism and the development of critical thinking skills are not seen as purely academic matters, but as essential to daily life.!

Market Update

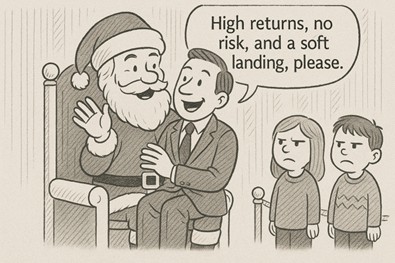

OK, perhaps a touch data-heavy for the Christmas edition, but this is really well done and actually very funny if you are an investment nerd. Mario from Hamilton Lane lays out a story, through several charts, that makes a compelling case for their particular brand of investing.

We are not particularly good at predicting market returns. (We know, we say we are, but we have to because everyone says they are.) But there is a statistically significant historical correlation between forward price-to-earnings ratios and go-forward S&P returns. Right now, you can see where that burnt orange diamond is located. It says future S&P returns are unlikely to be as high as they’ve been the past five years.

How to Speak to a Computer

An essay that is more of a history of technology than anything else. This is a worthwhile read to understand the path to the current AI boom, and the potential societal implications of excessive interaction with a machine that pretends you are an infallible genius.

A shallow impression of intelligence, it turned out, was all it took for people to project human traits, like empathy and care, onto their computers.

Is it a Bubble

It has been a while since we featured a memo from Howard Marks, but this one was an easy pick. Even for those who are well versed in the markets and the speculation in some corners of technology, this is worth a read.

Oracle, Meta, and Alphabet have issued 30-year bonds to finance AI investments. In the case of the latter two, the yields on the bonds exceed those on Treasurys of like maturity by 100 basis points or less. Is it prudent to accept 30 years of technological uncertainty to make a fixed-income investment that yields little more than riskless debt? And will the investments funded with debt – in chips and data centers – maintain their level of productivity long enough for these 30-year obligations to be repaid?

Gallant MacDonald is a Private Investment Office serving a select group of ultra-high net worth families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!