Peaks and Troughs

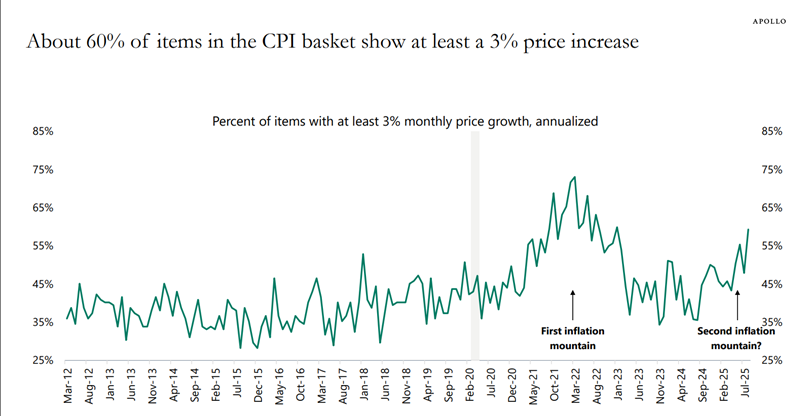

The resurgence of goods inflation is high on the list of data points we are watching at the moment. If inflation comes in higher than expected, the narrative around a steady decline in rates is sure to wobble. With valuations looking stretched, higher rates are one of many catalysts that could produce short-term volatility. Fundamentals remain strong, but a lot is riding on the lower rate and artificial intelligence (AI) dominance themes.

Capitalize for Kids

We are incredibly proud to say that our annual Capitalize for Kids Investors Conference raised over $3M in its 12th year! The funds will go to support innovative solutions to scale and improve the quality of care in the youth mental health space.

We were fortunate to host The Right Honourable Stephen Harper, General David Petraeus, Bob Prince of Bridgewater, Mario Giannini of Hamilton Lane, and many more. Huge thanks to our speakers and those who supported the cause!

End of an Era

At 95 years old, Warren Buffett has announced he will no longer be penning the annual letter or running the annual Berkshire Annual General Meeting. He is officially handing those duties to Greg Abel, a good Canadian kid, as the CEO transition continues. We have thoroughly enjoyed stealing a bit of wisdom from Buffett during the odd trip to Omaha and are sad to see an end to this era.

We are thankfully still going to get Thanksgiving letters. The first is appended here.

Those who reach old age need a huge dose of good luck, daily escaping banana peels, natural disasters, drunk or distracted drivers, lightning strikes, you name it.

But Lady Luck is fickle and – no other term fits – wildly unfair. In many cases, our leaders and the rich have received far more than their share of luck – which, too often, the recipients prefer not to acknowledge.

What the Bubble Got Right

With all the talk of an AI bubble, we thought it was a good time to send around a classic from Paul Graham. This was written in the aftermath of the 90s tech bubble and has some great lessons.

New technologies can achieve valuations that are irrational because the timeline is wrong. i.e. implementation just takes longer than the market expects. If you believe the thesis is still good, then volatility is actually an opportunity.

The fact is, despite all the nonsense we heard during the Bubble about the “new economy,” there was a core of truth. You need that to get a really big bubble: you need to have something solid at the center, so that even smart people are sucked in.

Now the pendulum has swung the other way. Now anything that became fashionable during the Bubble is ipso facto unfashionable. But that’s a mistake—an even bigger mistake than believing what everyone was saying in 1999. Over the long term, what the Bubble got right will be more important than what it got wrong.

In Defence of Luck

Another article focused on the role of luck in a successful life. There is certainly a lot we can do to influence the impact of chance in our lives, but we should appreciate the role it plays.

What about effort, skill and planning? All necessary, of course—but never sufficient.

AI App Building

We wouldn’t typically link to what is essentially a commercial, but this is a great example of just how accessible AI has made coding and development. There are many tech solutions to this problem, and a lot of people are working on making them even better. If you haven’t been following the progress, this is worth a watch.

Gallant MacDonald is a Private Investment Office serving a select group of ultra-high net worth families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!