RISE OF THE MACHINES

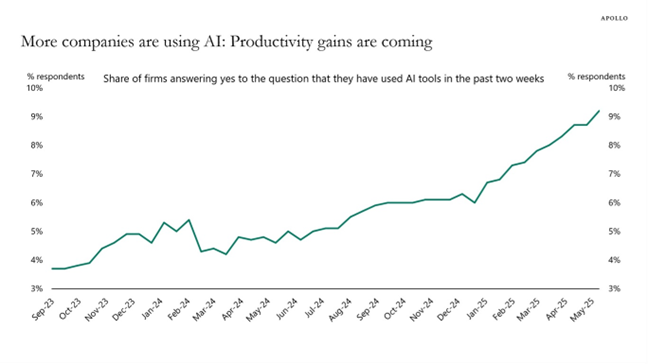

The curve above is rising fast, but we think it could be underestimating the true impact artificial intelligence (AI) is having on productivity. As a reminder, the current AI models are absolutely the worst they will ever be…and they are very good.

Almost every fast-growing business we know is figuring out new ways to utilize AI almost daily. A lot of human intervention remains mandatory at this point, but if you extrapolate the trends, you can clearly see a fundamental shift is in the works for a large fraction of all businesses. We worry a lot about “left-tail risk” (i.e. the bad stuff) in these musings. AI adoption might just be the panacea that allows businesses to maintain, or improve on, historically elevated margins and valuations. See, we are optimists at heart.

More on Repealing the Laws of Economics

We may have featured Howard Marks too many times lately, but his recent work has been insightful even in the context of the very high bar set by his past memos. This one is a deep dive on a few concepts that would be excellent for society, if they worked.

Our elected officials may believe the status quo can be maintained forever, or more likely they count on being out of office by the time the wheels come off. But certainly, they’re not facing up to reality. The behavior in Washington with regard to both the fiscal deficit and the precariousness of Social Security remind me of the tale of the guy who jumped off the 20-story building. As he passed the 10th floor, he said, “So far, so good.”

Scaling High Trust Culture & Bold Judgement

A podcast with Reed Hastings, Co-Founder of Netflix. We borrowed several of Reed’s policies in the early days of Gallant MacDonald and have a particular reverence for his contrarian approach to culture.

Success is having a positive impact on other people…doing good for others would be my core definition of success.

Expected returns in the stock market

An exploration of the various sources of returns in markets, i.e. dividends, earnings growth, and “exuberance” (valuation expansion or contraction).

The past is great and all but investors care more about what happens in the future.

The current dividend yield of the U.S. stock market is 1.3%. Let’s assume technology and AI keep earnings growth above average from productivity and efficiency gains — call it 7-8%. On pure fundamentals alone, that’s pretty good, even if my earnings estimates are too high.

The unanswerable question is how do investors feel about stocks? That’s all valuations are, is feelings.

UBS Global Family Office Report

This may fall into the category of ‘more interesting to us than to others’, but we do think it is worth a quick look. The report provides an analysis of trends and asset allocation for some of the largest family offices globally. The theme of families continuing to look more and more like institutions (the Family Pension Fund) persists.

Capitalize for Kids hosted the 8th Annual Bay Street Games last month and broke previous fundraising records with over $430,000 raised for Canada’s youth mental health sector. The event was as intense as ever, with teams of six competing to be Bay Street’s fittest firm. Will you take a shot at the title next year…?

We are excited to announce that Kyle MacDonald has taken on the Chair role for the IWK Foundation Board of Trustees. Kyle has been a long-serving member of the Board and has Chaired the Finance and Investment Committee. It is an incredible organization, and Gallant MacDonald is privileged to be associated with it.

Gallant MacDonald is a Private Investment Office serving a select group of ultra-high net worth families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!