Managing expectations

In recent months, we have talked about the implications of highly uncertain trade policy more than we’d like.

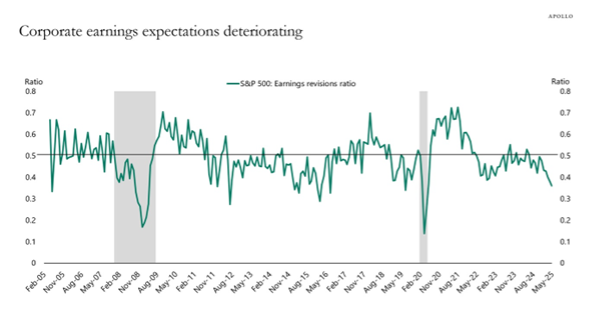

The graph above illustrates the impact of recent trends on earnings expectations. While the direction of the trend is probably not surprising, we would emphasize that the magnitude of potential earnings remains highly speculative. If we continue to trend in the direction of more “normal” policy, this could simply be a blip. That said, we worry that if rhetoric and action continue to surprise, we may have a lot further to fall.

The AI Revolution Is Underhyped

Former Google CEO, Eric Schmidt, recently shared an in-depth analysis of his views on the current state and future of Artificial Intelligence (AI) . The most interesting components involve businesses that can’t exist under our current system due to cost or complexity, and how AI systems can solve those problems.

Why do we not have a tutor for every human being on the planet? The only possible answer is there must not be a good economic reason.

The delusion of private equity IRRs

While this article could probably use a little more nuance, it certainly highlights a point we think about often: IRRs in private equity are a useful metric, but have little value when considered in isolation. A deeper dive is required on any games played with distributions, the investor-level ability to effectively deploy uninvested capital, and the sources and sustainability of returns.

This IRR stickiness is fertile ground for gaming. Fund managers know how to juice it. It’s not fraud — it’s strategy. But the consequences are real, as people are often presented these numbers as actual rates of return, and frequently believe them. This distorts the decisions of private equity firms.

We live like royalty and don’t know it

A routine reminder of how good our quality of life is relative to virtually every other human being in history.

Jefferson was one of the richest men in the new United States…But despite his wealth and status his home was so cold in winter that the ink in his pen sometimes froze, making it difficult for him to write to complain about the chill.

Time is a Thief

A quick and rightly optimistic piece on why markets tend to go up over time. The concept in its most basic form:

There are way more people who want things to be better, not worse. And that demand incentivizes entrepreneurs and businesses to supply better goods and services. The winners in this process get bigger as revenue grows. Some even get big enough to get listed in the stock market. As revenue grows, so do earnings. And earnings drive stock prices.

Join us in congratulating Nick Challis on his promotion to Associate Portfolio Manager!

Since joining Gallant MacDonald, Nick has been instrumental in enhancing our investment due diligence processes, co-leading both investment and operational research initiatives.

His promotion is a testament to his analytical rigor, client-centric approach, and the leadership he brings to our team. We are proud to recognize Nick’s contributions and look forward to his continued impact in his new role.

Gallant MacDonald is a Private Investment Office serving a select group of ultra-high net worth families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!