Confidence Game

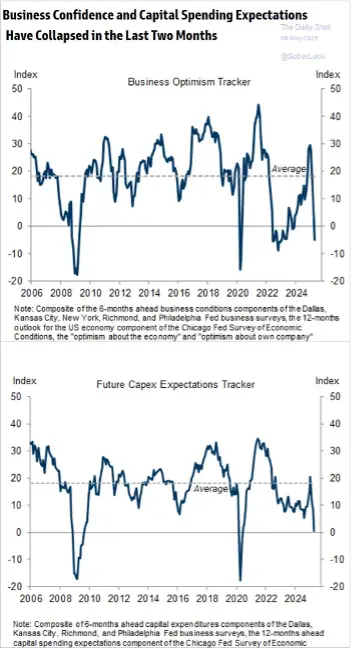

Markets have rebounded strongly off the tariff-induced lows of April. That said, business confidence and investment intentions remain depressed.

We believe that volatility will remain high, both to the downside and the upside. It may not be relaxing, but these types of markets tend to breed excellent long-term opportunities.

New Hires

We are proud to announce two new additions to the Gallant MacDonald team!

Matt Goldman joins the Investment team from Harbourvest and was previously at CPPIB. He will be focusing on private equity as well as broader client relationships and special due diligence requests.

Jordan Cohen joins the Client Experience team with a strong background as a Senior Private Client Associate. He will be specifically focused on statement consolidation and enhanced reporting.

We are excited to welcome them both to the team!

Why There Will Never Be Another Warren Buffett

This month, Warren Buffett finally announced his retirement from Berkshire Hathaway. Buffett will step down as CEO at year-end but will retain the Chair role, given he is still just a boyish 94.

It is impossible to overstate the magnitude of wealth Warren was able to create for Berkshire shareholders via a combination of remarkable skill and uncommon longevity. There will never be another Warren Buffett.

As a young investment manager, Buffett would wander through his house with his nose in a corporate annual report, practically bumping into the furniture, oblivious to the comings and goings of family and friends. While his kids played at an amusement park, he would sit on a bench and read financial statements. Buffett was there physically, but mentally and emotionally he was off in a world of his own, fixated on tax-loss carryforwards and amortization schedules.

Imagine being that obsessed. Imagine enjoying it.

Now imagine enjoying it almost every waking moment ever since Harry Truman was in the White House. That’s how unusual Buffett is.

Bruce Flatt: The Trillion-Dollar Blueprint

A relatively rare interview with the CEO of Brookfield, Bruce Flatt. Brookfield’s scale is staggering, with over $1 trillion of assets under management. There are few firms in the world that would have more knowledge (and ownership) of the world’s crucial real assets.

50% of the backbone of what we own today did not exist as an asset class for investment 20 years ago

Has Private Credit Lost its Shine?

This may fall into the camp of being too technical for some, but it is an excellent deep dive into the various drivers of credit markets. With all the noise around tariffs, this topic comes up frequently—so we thought it worth including for those who like talking debt!

The yield to maturity (YTM) for leveraged loans averaged 5.52% over the decade leading up to 2022’s rising rate environment. From 2022 to 2024, the average YTM was 9.56%, up 73% over the prior decade. And while the YTM softened from 2023 to 2024, particularly as spreads tightened, we anticipate leveraged loans overall will benefit from a higher-for-longer rate environment.

Pricing: A List of Tactics

This is a great case study in human psychology. No need to read the whole list but take a look at a few of these and marvel at how much effort has gone into tricking you into buying a protein bar.

Customers focus on absolute numbers.

They often prefer $10/month to $120/year because a smaller base value feels more pleasing.

But it works for any lower base value.

Reframe a Price Into:

Monthly Price. Yearly SaaS plans often depict an equivalent monthly amount ($25/month billed annually).

Daily Price. Anything under $4.00/day is persuasive to mention (Gourville, 2003).

Petty Expense. Like a cup of coffee (Gourville, 1999).

Per User. Describe your $10k/month B2B software as $67/user per month.

The Most Valuable Commodity in the World is Friction

The argument is that our devices create an illusion of a frictionless world: a seamless user interface that tells you when your car arrives, your flight will land, or your package will be delivered.

The issue seems to be that the infrastructure supporting the average promise isn’t keeping up. It might just be fond memories of the ‘good ole days’, but when you see incidents like the Newark air traffic control meltdown happening more often—backed by a real observed decline in spending—we buy the argument that a bigger issue is brewing.

We have a world where friction gets automated out of experiences, aestheticized in curated lifestyles, and dumped onto underfunded infrastructure and overworked labor. The effort doesn’t disappear; it just moves.

Gallant MacDonald is a Private Investment Office serving a select group of ultra-high net worth families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!